I have in my possession a deck of Byron-branded playing cards given to me seven years after the burger brand’s launch to commemorate it having completed a set of 52 restaurants - its Oxford Circus restaurant for example was the Queen of Diamonds, Chiswick the Ace of Spades. As the blurb on the back of the red playing card pack said: ‘Not a bad hand to have’.

We all know what happened a few years hence. Another 13 restaurants would be added to the group’s portfolio, taking it to its height of 65, before things started to collapse like, well, a house of cards. From 2018 onwards, when it closed almost a third of its estate as part of a Company Voluntary Arrangement and the musical chairs of different ownership began, Byron was less full house and more busted flush, if you’ll permit me to continue the card playing metaphor. Its ‘first deck’, as it optimistically wrote on the back of the pack, proved to also be its last.

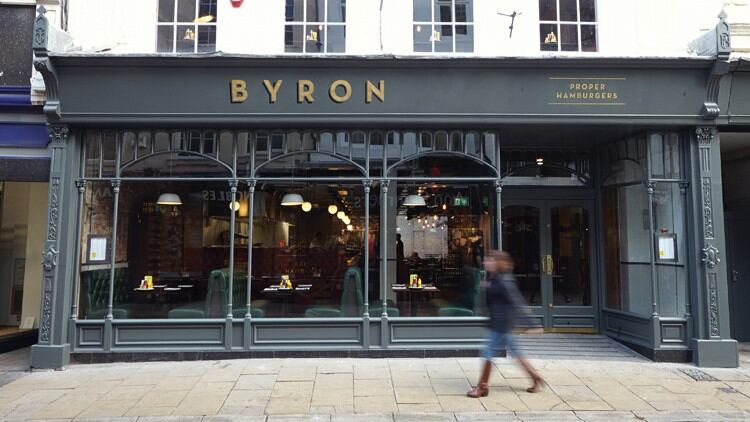

Today, Byron is a husk of its former self, with a portfolio of just seven restaurants, and like many people in the industry I concluded that that would be that. It seemed almost inevitable that the now bijou burger group would be absorbed into a larger restaurant entity interested in its sites, which are dotted around the country in cities including Liverpool, York, and Cambridge, rather than its name.

Restaurateurs certainly see an appetite for British-born brands overseas, with the US and the Middle East obvious targets

And yet how wrong I have been proven to be, with the brand snapped up by Niyamo Capital, founded by the Indian-born investor Akshat Tibrewala. Described as a Gen Z entrepreneur, 21-year-old Tibrewala, like Byron’s previous owners, still sees potential in the burger brand, and in particular overseas, and has put £2.5m where his mouth is.

The difference between Niyamo Capital’s approach to Byron and those that have gone before it seems to hinge on its ambitions for the brand. While previous owners have looked to restart the brand’s expansion in the UK, trying to return to its premium burger quality roots, as well as lean into the fried chicken dark kitchen brand Mother Clucker also under its control, Niyamo Capital has made it clear that it is overseas where it believes the brand has the most potential.

“Dubai has a lot of British presence now. Given that Byron was a UK-based brand … Dubai is a market we feel is going to have recognition as soon as we enter,” Tibrewala told the Sunday Times. “What we essentially want to do with Byron is look at the identity — proper hamburger, good-quality meat and British brand origin - and rebrand it for new consumer tastes and preferences, whether that be smashed [burgers] or different concepts that are relevant nowadays.”

In Byron, Tibrewala sees a brand with a strong British identity - even the name has connotations of Cambridge educated English lords and English romanticism - one that can be exported. Indeed, Byron over indexes in terms of brand recognition in the UK in comparison to its size - partly because of the presence it once had across the country and partly because of its trailblazing qualities that struck a chord with a burger loving population. He clearly believes that such brand recognition is essential when entering new territories.

In this regard he’s not alone. Restaurateurs certainly see an appetite for British-born brands overseas, with the US and the Middle East obvious targets. Martin Williams, CEO of Evolv Collection, recently spoke about his plans to take some of the group’s brands overseas, in particular those with a strong British heritage. “There are certain areas where they’re still quite hungry for great brands and... we have half dozen brands created in London by Sir Terence,” he said, citing its ‘heritage brands’ such as Bluebird and Quaglino’s. “Particularly in the UAE, where they want the best of London. “[These brands] were born in London and founded by a knight [of the realm]. It’s a very rich proposition that has amazing growth potential.”

When I recently spoke with Ross Shonhan about the opening of his quintessentially British restaurant Lilibet’s, which pays homage to the childhood home of the late Queen Elizabeth II, he mused that it was a concept that could work Stateside because of a renewed interest in Britishness across the pond, especially in fashion and design. Fashion brand Burberry has recently had success by refocusing on its British heritage, and this won’t have gone unnoticed.

Of course, burgers aren’t Burberry and Byron will be up against newer, arguably cooler burger brands, smashed or otherwise, that have already made the move in the UAE, including Supernova, which has sites in Riyadh and Bahrain.

Niyamo Capital’s swoop for Byron feels like the last chance saloon for a brand that helped change the face of the burger sector in the UK before becoming a victim of its own success.

Having a new focus seems the only feasible option left to it, and a fresh perspective and young pair of eyes in Tibrewala is a potentially mouthwatering proposition. He now holds the cards, so let’s see what hand he plays next.