Sources told The Times that the group has have drafted in Christie & Co to sell between 30 and 50 of its worst-performing sites, most of which are situated next to Premier Inns, which is also part of Whitbread’s portfolio.

A further 100 sites are expected to be converted into extra hotel rooms for Premier Inns.

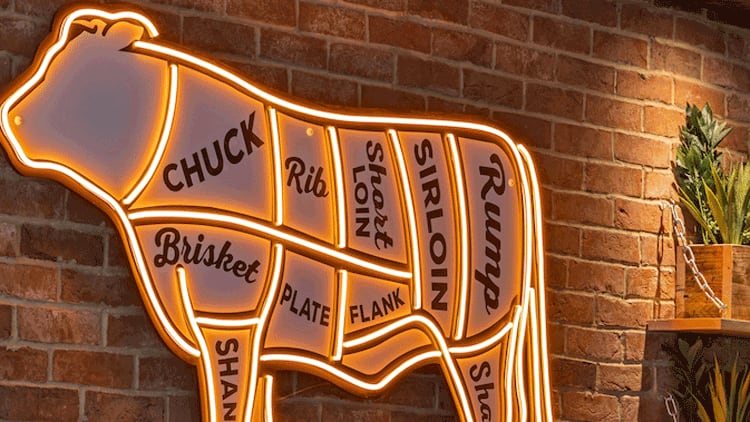

It comes after Whitbread hired advisers at Goldman Sachs to explore options for its pub and restaurant division, which houses the Beefeater, Bar + Block and Brewers Fayre chains, last year.

According to The Times, the group subsequently entered exclusive talks to sell the arm to Platinum Equity, the Beverly Hills buyout fund that tried to acquire pub chain Marston’s in 2021.

However, the deal collapsed after the pair failed to agree a price.

Alongside the plans outlined above, Whitbread is also reported to be mulling options for the remaining 250 sites in its pub and restaurant division.

When contacted by Restaurant, Whitbread declined to comment.

In its most recent annual report, published in May last year, Whitbread wrote of 'the increasing divergence of performance of the hotel business and the food and beverage business', which the group warned could have a detrimental effect on the price charged for Premier Inn rooms.

Its F&B sales were 40% ahead of FY22 for the 52 weeks to 2 March 2023, however, they remained 4% behind pre-pandemic levels.

In January, Whitbread sold its stake in health-focused grab and go brand Pure with the group saying the brand ‘was not part a core part’ of the group’s strategy.