The research, carried out by Populus on behalf of Money&Co, revealed that there is a £4.3 billion gap between loan applications by SMEs and loans awarded to businesses.

For small businesses with 10-49 employees, the average funding gap was £11,752 per business, while medium sized firms with 50-249 employees faced an average funding gap of £69,961.

Of the 301 senior financial decision-makers from UK SMEs that took part in the survey, two thirds said they believed the traditional banking system was broken, with more than half agreeing that bank bureaucracy would put them off from applying for a loan.

The report follows the recent news that HSBC is setting a £6 billion fund for lending to UK SMEs.

HSBC head of business banking Amanda Murphy claimed the fund would be a ‘turning point’ for lending to small businesses, but Nick Baker, director and head of Business Mortgages at specialist commercial mortgage broker Christie Finance warned that businesses might still struggle to secure loans.

“Whilst HSBC’s announcement is undoubtedly welcome news for SMEs, it is the stringent criteria being applied to such loans, especially over cautious debt servicing tests, which remains an issue — not the availability of capital,” he said.

“So, while the funding will hit the mark, it in some ways misses the point.”

Crowdfunding

So is crowdfunding the answer to the funding gap?

According to the Populus survey, most SMEs are still not convinced, with 72 per cent stating they would still approach a bank first for funds, and just 4 per cent indicating that they would use crowdfunding.

However, there have been some successful examples of crowdfunding ventures in the hospitality sector not least Pizza Rossa – which raised £440,000 in just 17 days through a crowdfunding campaign, and broke the European record for securing start-up funding.

Another noticeable success story is The Clove Club, which raised money through crowdfunding site CrowdCube and went on to become the first crowdfunded restaurant to make it onto the World’s 50 Best Restaurants 2014 top 100 list.

Alternative finance

Nicola Horlick, chief executive of new crowdfunding venture Money&Co, said that crowdfunding offers some excellent opportunities for SMEs like restaurants, hotels and pubs.

“This research clearly shows that the banks are not providing UK SMEs with the finance they need. Although recent figures indicate that the UK economy is beginning to experience growth, we cannot ignore a funding gap of such magnitude. The £4.3 billion funding gap isn’t just acting as a barrier to UK SME growth, it could potentially stifle the UK recovery,” she explained.

“Crowdfunding can help address the banking shortfall. The sector is experiencing a surge in interest and demand as businesses start to recognise a real alternative route to finance exists. Crowdfunding provides a great opportunity to both credit-worthy businesses and investors, offering them something they aren’t getting elsewhere: easily accessible finance and good interest rates."

John Allan, national chairman of the Federation of Small Businesses, agreed that alternative financial providers will be key to SME growth.

“Opening up banking sector competition through alternative finance providers is something the FSB has long called for,” he explained.

“The FSB’s own research has shown many businesses are still refused finance, even as the economy is getting stronger. We want to see the banks and government signpost businesses to using alternative finance providers to ensure they get the cash they need to grow.”

For more on options for funding an independent restaurant, hotel or bar, read our latest

, with spotlights on the banks, private equity, using your own funds and alternatives like crowdfunding.

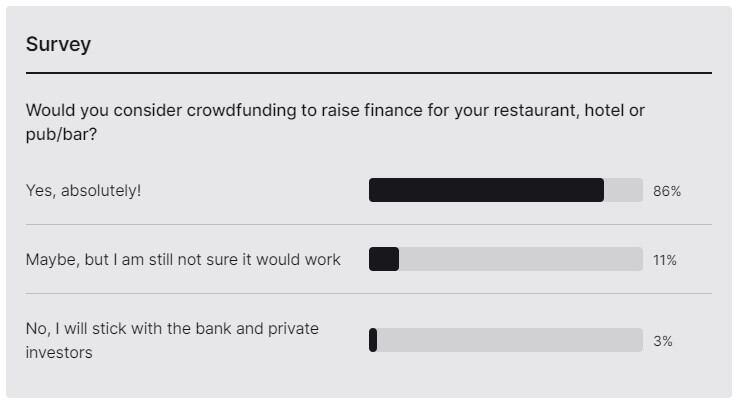

Poll: would you consider crowdfunding as a source of finance?

Would you consider crowdfunding as a way to finance your business? Or will you stick with traditional revenue streams like banks and private investors? Let us know by taking part in our poll below.